I’m going to try to make this quick this month. I’m in South Korea, visiting my wife’s family, and, with two babies to take care of, I’m struggling to get any work done at all! It’s often the way with going on holiday that, before you arrive, you think you’re going to get all this work done and then, once you’re there, it just doesn’t happen!

Ahead of 2023, I’m planning to briefly run through my thinking on oil – being nearly 100% into energy equities. Energy equities remain about the cheapest stocks in the market at current commodity prices. Meanwhile, in my view, we’re at the beginning of a global energy shortage – prices are set to go much higher.

November was a rough month, with WTI oil going down well into the $70s and Vermilion Energy (VET.TO) crashing after earnings. The volatility has been high all year.

The plan is to stick with the same trade until the thesis gets proven out: for companies to trade at a reasonable multiple of free cash flow – once energy prices are higher. It remains a waiting game – and eating Korean barbecue and drinking a lot of iced lattes is probably a better approach than being too active with the trading in the meantime!

Contents

Performance

Oil inventories

On recession

EV adoption

Demand catalysts

US shale

Portfolio

Final thoughts

Performance

YTD: +10%

2021: +10%

2020: +49%

2019: +51%

Oil inventories

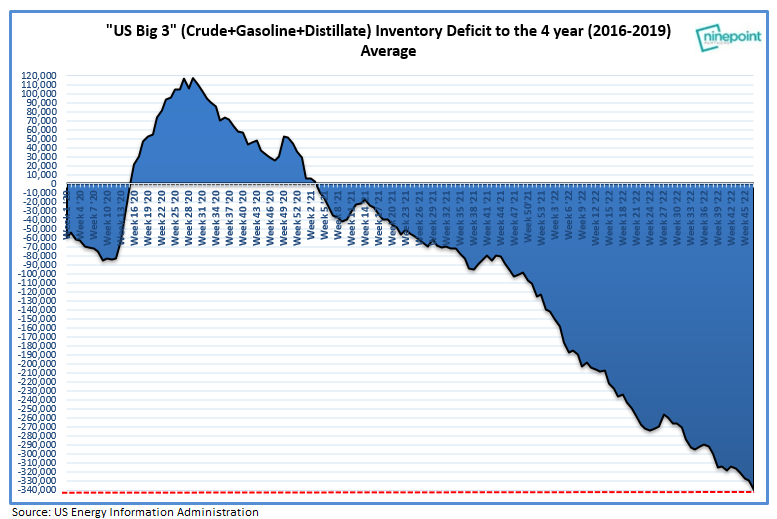

We’re due for a rebound in oil prices, to the $100-130 range, over the next year or so. If we were to just look at the oil price, we could be forgiven for thinking there isn’t a problem with supply. The inventories tell a different story.

Even with China still locked down, aviation demand not yet restored to pre-Covid levels and the record releases from the US Strategic Petroleum Reserve (SPR), US inventories are still drawing. Global inventories, after stripping out the SPR releases, are also still declining.

The market seems to be pricing in a severe global recession to reduce demand and/or a material increase in supply.

On recession

On the risk of recession, it should be remembered oil demand has grown every year since the late 1800s, bar a handful of years of severe recessions, recently by about 1-1.5% a year. On emerging from those recessions, demand has again re-joined its upward trajectory.

If there is a severe global recession which craters demand, in theory all we have to do is sit tight and wait for the recovery where – like following Covid – demand will return while investment in supply has been stalled. (The volatility, of course, would not be pleasant!)

However, the world is hardly at an economic peak, firing on all cylinders, right now. The facts that China is locked down and will reopen at some point, that aviation demand is still depressed and that, globally, natural gas is in short supply (creating some switching to oil for power generation) all soften the blow from any global recession. My base case is that China and other Asian economies emerging from lockdowns will more than make up for recessions elsewhere. Add a Fed pivot into the mix and we have the potential for some ripping demand in 2023.

EV adoption

It could be that the oil price is discounting falling demand, following a recession, from electric vehicle (EV) adoption. This was the case put forward from many quarters during the Covid pandemic: that 2019 was peak demand, and rapid adoption of alternatives in the Covid recovery would be the inflection point that would reverse oil demand’s long-term trend. This turned out to be wrong, and it seems very wishful thinking to assume any different this time.

The percentage of global vehicles that are electric is growing, yes, but so is the global vehicle fleet, meaning that the total number of internal combustion engine (ICE) vehicles is actually still rising. EVs and renewables have grown rapidly in percentage terms, but from a small base; they will come up against some serious scaling problems due to materials constraints.

Then you have to consider how we will power all the EVs when electricity grids are already under stain with a global natural gas shortage. Switzerland has just announced it could ban the driving of EVs this winter, unless for “absolutely necessary journeys”, to avoid blackouts.

In addition to the global vehicle fleet growing, developing economies are growing in general, which means more demand from all other areas of the economy which are reliant on oil.

Demand catalysts

We have so many bullish catalysts for oil.

Two of the biggest of these are China reopening and the end of the US Strategic Petroleum Reserve (SPR) releases.

China has confounded us so far with, first, the unbelievably draconian lengths it’s gone to to lock down the country, and then the length of time the restrictions have remained. However, China has to reopen sometime, and China demand coming back seems not to be discounted in the oil price at all. We’re now seeing anti-lockdown protests across China and civil unrest. The question is how long can lockdowns go on for? The policy seems to be at breaking point.

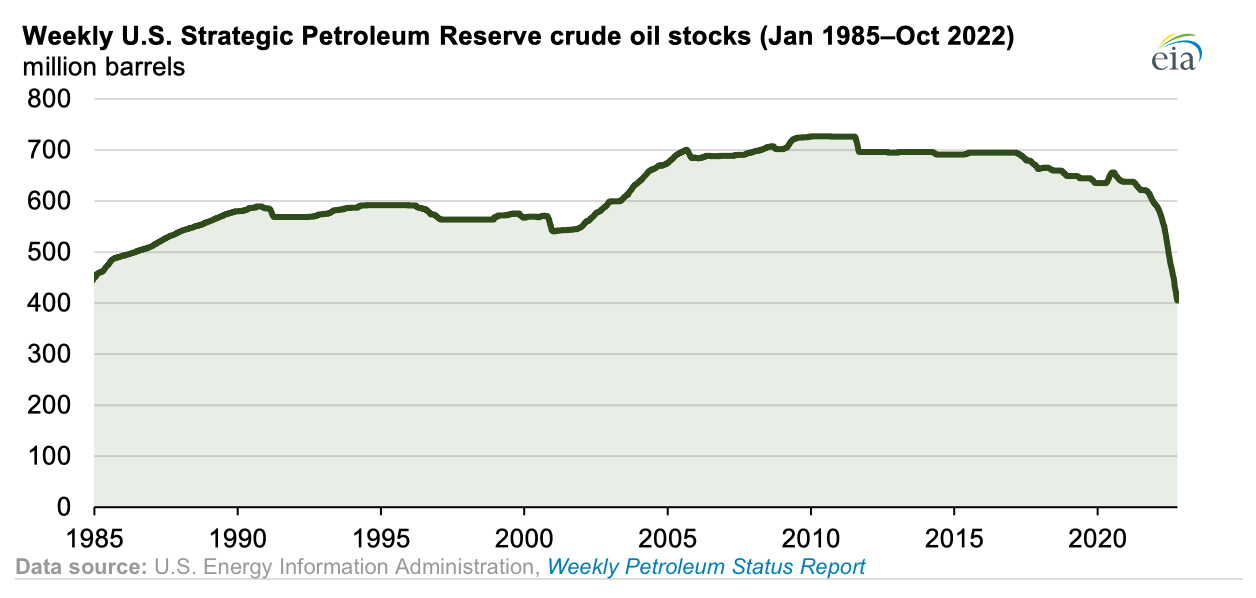

At the same time, the SPR is at its lowest level since 1984. It has declined by 204.3m bbl so far this year, to a level of 389.1m bbl.

Last week, the US Energy Security Advisor said that the White House intends to refill the SPR when oil prices are “consistently” at or below $70/bbl. Whether the price gets to be consistently below $70/bbl in the near future is highly doubtful – the world knowing the US government intends to go from sellers to buyers at that level should help to backstop the price – but the announcement indicates the White House wants to stop drawing the reserves.

What level of emergency reserves they view as minimum we’re not sure, if they even have an answer to that question, but it’s clear they don’t intend to run the SPR dry. Some of this oil has already been earmarked by Congress to sell in 2024-7 to pay for legislative initiatives, which Biden is now trying to cancel so the reserves can be refilled. Perhaps they can continue drawing for a few months if oil prices don’t comply.

One possible scenario, that, after a few months, the White House is forced to stop drawing the SPR just as China reopens, could be quite spectacular. It appears to me all the catalysts are coming together at once for the mother of all oil shocks!

US shale

The US, the only source of non-OPEC supply growth over the last decade, became a new swing producer, with its shale projects that, contrary to traditional resources, only take a few months to bring online.

US shale was therefore widely expected to be able to turn on the taps this year and come to the rescue. US production growth, however, has disappointed in 2022, and the data is not encouraging for scaling up shale from here.

Following Russia’s invasion of Ukraine, when oil broke through $100/bbl for the first time since 2014, most analysts predicted a strong response in drilling. However, the response has remained subdued. In November, US production was at 12.1 mb/d, up from 11.7 mb/d in December 2021, an increase of only 400,000 b/d over the year. This is so far falling short of even Pioneer CEO Scott Sheffield’s forecast in March of 700,000 b/d growth when 1 mb/d was widely expected. In addition, this was with using the large inventory of drilled but uncompleted wells (DUCs), drilled during or prior to Covid. Most of the DUC inventory is now gone.

This chart from Goehring & Rozencwajg show how the relationship between price and drilling activity has broken down.

There are many reasons companies are not focusing on growing production, a key one being that they can simply create better returns by buying back their own stock, when at a discount to NAV, rather than investing in production growth. In addition, investors want capital returns and therefore production growth is being punished by the market.

Tier 1 acreage in the Permian is running low. Companies don’t want to exhaust their prime assets when oil is in the $80/bbl range only to report production declines in future years when the oil price is higher. Also, Permian production has already reached huge scale – and shale takes enourmous capital investment just to keep production flat – it will not continue growing like it has done.

The Goehring & Rozencwajg Q3 report comments:

“On the one hand, you could increase activity, risk attracting the ire of policymakers, have your stock price go down, and deplete your irreplaceable asset. On the other hand, you could return capital to shareholders, stay under the radar of policymakers, have the market reward your capital discipline, and keep your Tier 1 assets for a later time when the market will better value them.

Is it any wonder energy companies are not drilling?”

Companies are not drilling because of record low valuations. The beauty of the trade is that for oil prices to come down in the long term (from supply growth), stock valuations have to go up; investors either get higher stock prices from a market rerating or from company buybacks.

Portfolio

In November, I trimmed the VET.TO position to rebuy VET calls (after my narrow escape the last time!), this time January 2024 $20 calls.

I trimmed SGY.TO, JOY.TO and HME.TO a little to buy a new position in ARCH, a coal miner. I think being somewhat diversified across oil, gas and coal makes sense – and I may add a little further to the coal position.

Final thoughts

We’re seeing a lot of volatility in the oil price. As I write, WTI is again at $74. I’m surprised by this, on the one hand, as I’m convinced it’s totally mispriced; on the other hand, I take it in my stride by now as we’ve seen this happen repeatedly.

I don’t see short-term volatility as bearish for prices longer term – quite the opposite: as Josh Young, CIO of Bison Interests, has pointed out, higher uncertainty demands a higher average price in order for companies to invest in new supply. Paradoxically, lower prices now are actually bullish longer term, draining inventories and discouraging investment!

So the message from me is, if we’re convinced of our thesis, to sit tight and not to pay too much attention to the market. The market “is there to serve you and not to instruct you”, remember! Sometimes it can be good to travel and not to check it every day!

Written by Timothy Lamb

Blog: www.retailbull.co.uk

Twitter: @theretailbull

Disclosure:

The writer owns shares in VET.TO. SGY.TO, JOY.TO, HME.V, MEG.TO, WCP.TO, ARCH and EMBK at the time of writing.

Disclaimer:

This article is for informational purposes only, does not offer investment advice and does not recommend the purchase or sale of any security or investment product. Please see the full disclaimer on the About page.