"Bitcoin has no top because fiat has no bottom.” – Max Keiser

I’m now up overall for the year to date because of the bitcoin rally, which is somewhat of a relief after some disasters and being in the red all year!

The outlook for bitcoin has rarely been better. After adding to the position throughout the year, plus the price appreciation, the portfolio is now about two thirds bitcoin exposure (through bitcoin and MSTR stock) and one third energy. We are in for a major bitcoin bull market over the next two years, and my conviction on the trade increases constantly. Laser eyes have finally been adopted on X!

Catalysts for bitcoin include:

The expected approval and launch of US spot bitcoin ETFs

The recent change of corporate accounting rules for bitcoin to fair value accounting

The supply constraints – as coins continue to be drawn from exchanges and find their way into the hands of long-term holders

The halving event just a few months away

1. Spot bitcoin ETFs

The consensus increasingly is that the eight to 10 applications for spot bitcoin ETFs will be approved and will launch over the next few months.

On 13 October, the deadline passed for the SEC to appeal its loss in the Grayscale lawsuit, where the court ruled the regulator was wrong to reject an application for the Grayscale Bitcoin Trust (GBTC) to convert to an ETF. The SEC must now follow the court’s order and review Grayscale’s application. Bloomberg ETF analyst James Seyffart said that an attempt to deny the application on new grounds was unlikely, although they could “find ways to keep delaying”.

However, the ARK Invest application deadline is looming. The 240-day SEC comment period for ARK’s bitcoin ETF expires on 10 January, and the SEC must either reject or approve it by that date. Since the SEC will not want to give any applicant an unfair advantage by first approval, all the applications that meet the requirements are likely to be approved on the same date.

Further, we have heard a stream of news that the SEC has been providing feedback to the applicants and that applications have been amended.

These circumstances have caused many commentators to propose that it’s likely we see all the ETFs approved by 10 January. It does seem a case of “when” and not “if” at this point, as it would be very difficult for the SEC to find a new, and winning, argument as to why the spot ETFs should be rejected while futures ETFs are allowed.

According to Bernstein Research:

“The market was waiting to see if the SEC would appeal against the Grayscale verdict. Now that SEC has chosen not to appeal, and actually, has been actively responding with edits/comments on the ETF applications, the probability of approval by the Jan. 10 due date looks highly likely.”

Neel Maitra, partner at Wilson Sonsini and former member of SEC crypto division, also said that a spot bitcoin ETF could become a reality in a matter of months.

Michael Novogratz, the founder and CEO of Galaxy Digital Holdings, which is partnering with Invesco on an application, said he expects an ETF approval before the end of the year.

On Halloween, Gary Gensler, Chair of the SEC, gave us a clue with this tweet, contrasting bitcoin’s properties of decentralisation with cryptos that are managed by companies:

On demand, Ernst & Young’s global blockchain leader Paul Brody says that there is massive pent-up demand from institutional investors awaiting the approval of a spot Bitcoin ETF – trillions of dollars waiting on the sidelines.

As to where the ETFs could take the price, new net demand has a big multiplier effect as it’s competing for the small available supply of coins. Galaxy Digital reported that they expect $14 billion to enter a BlackRock ETF alone, which could raise the price by 75%. Bernstein commented the price of bitcoin could rise to $150,000 by 2025 if the ETFs are approved. Fundstrat’s Tom Lee expects $150,000+ bitcoin by the end of 2024.

This has been, and still is, a rare opportunity for retail where we can see what is coming, and we are able to act on it, while the bulk of the institutional money is forced to sit out until the ETFs launch. Time is running out to be early to bitcoin!

2. Fair value accounting

In September, the Financial Accounting Standards Board (FASB) voted in favour of fair value accounting for crypto assets versus the current system of treating them as intangible assets.

The new rules are set to go into effect in 2025, but companies will be able to opt to apply them earlier. Until now, the accounting rules for bitcoin have discouraged companies from holding the asset on their balance sheets, as currently holdings have to be marked down to their lowest price but not marked up when prices rise. This negatively affects earnings statements and balance sheets.

Now that bitcoin can be accounted for at fair value, however, and balance sheet and earnings figures will be far more transparent, there will be greater incentive for companies to add the asset to their corporate treasuries.

3. Supply constraints

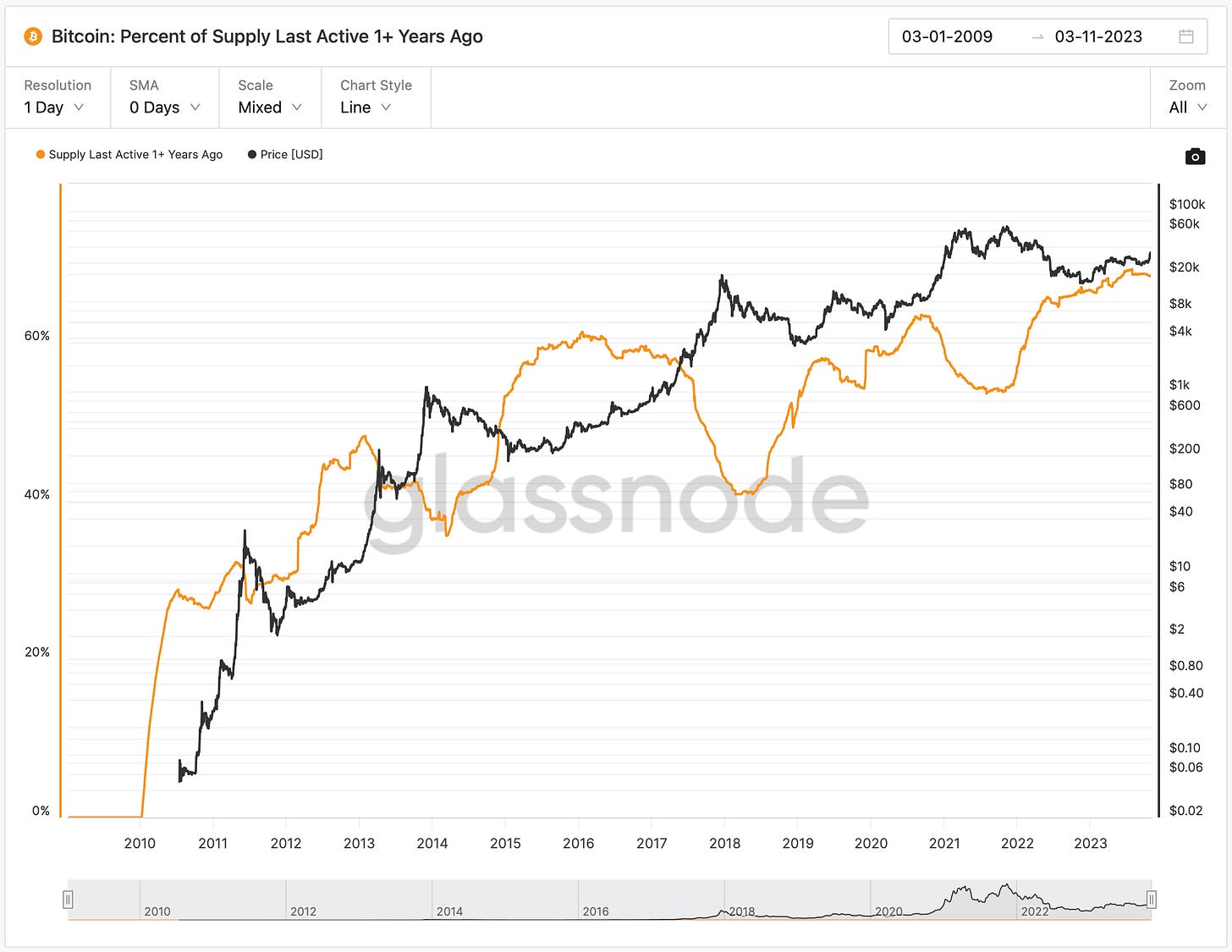

One of the most bullish indicators for bitcoin is its small available supply. The percentage of coins held by long-term holders (the circulating supply not moved in at least one year) is at a record high of 68%.

Bitcoin’s long-term holders have sat through the bear market and have slowly hoovered up most of the supply. These people tend to understand the asset extremely well and have unshakable faith in its long-term trajectory. No other asset has a holder base like bitcoin does – nicknamed “the psychopaths” by Preston Pysh. They know the patterns from the previous three halving cycles and they are not going to be selling large numbers of coins until the price is a multiple of the last cycle’s peak. Many will not sell even then.

Meanwhile, the number of coins held on exchanges has been drawing down to just over 10% of the circulating supply as long-term holders buy and send coins to their own private wallets.

This all means the number of coins available for the ETFs, and other new money, to purchase is severely limited, and therefore the price projections of the “psychopaths” will likely become a self-fulfilling prophesy.

4. The halving

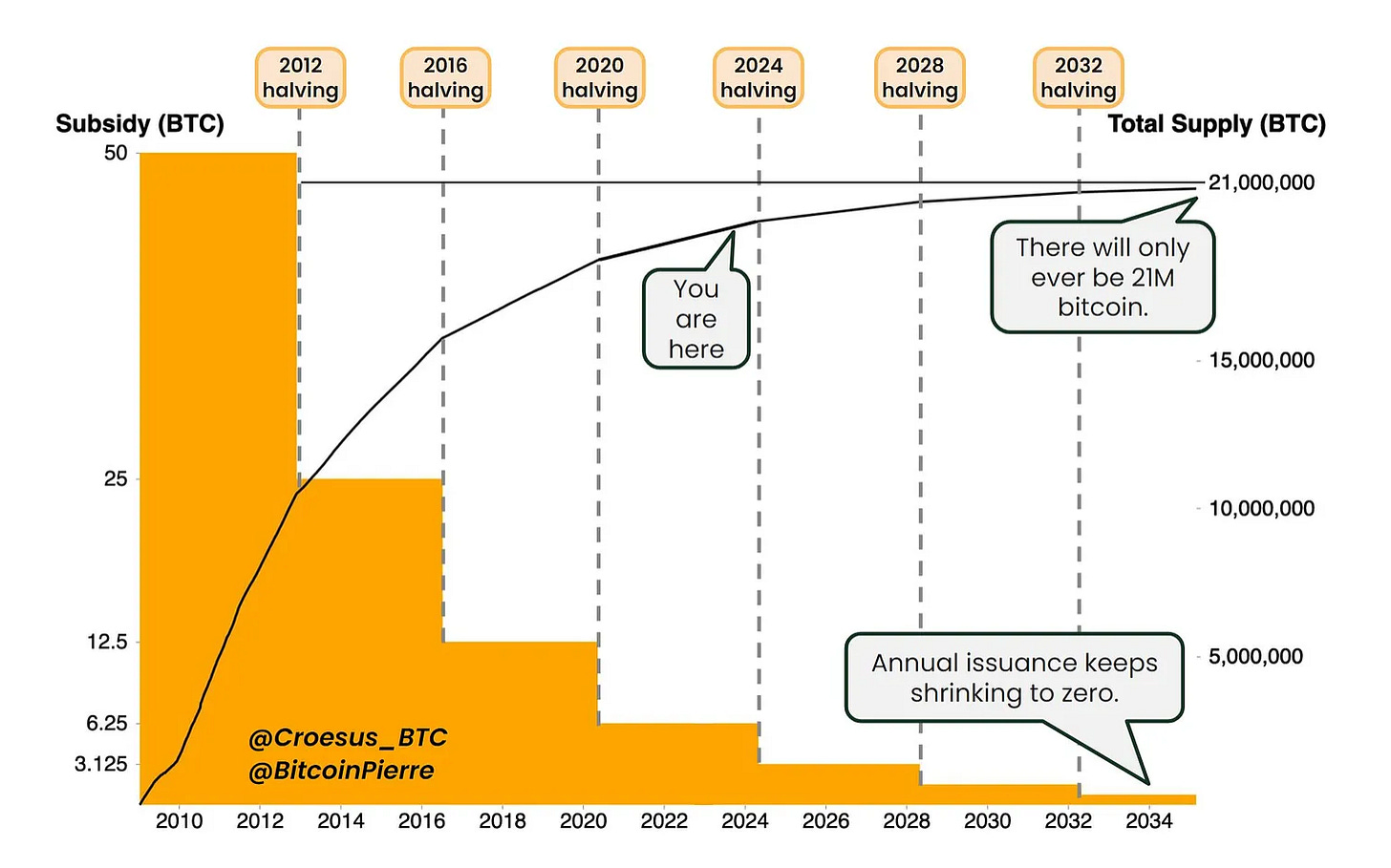

We have the quadrennial halving event next spring, where Bitcoin’s monetary policy – set in its code and secured by the network – dictates that the issuance is cut in half each four-year cycle.

The current 1.8% annual supply inflation is going to be cut to a mere 0.9%, making the asset “harder” than gold. All things being equal, even with demand remaining the same as it is today, this will force up the price.

Today, we have 900 bitcoins mined per day, which, when sold onto the market and multiplied by the current price of $35,000, equals $31.5m of net demand per day. This is the amount of daily net buying needed to keep the bitcoin price flat. In April 2024, this amount will be reduced by half, so only $15.75m of net buying will be needed to keep the price flat. The rest will go into price appreciation.

However, a lower inflation rate also makes the asset more attractive, and investors remember what has happened after prior halvings, which is likely to increase demand as well. On top of this, what happened following the three previous halvings was that trend followers and a new cohort of investors have jumped on the band waggon after seeing the price rip up. They either experience fear of missing out or greed, or they start doing their research late into the bull market, start dollar-cost-averaging and become next cycle’s new psychopaths!

Next bull market could be bigger than the last

Each successive bull market has been smaller than the last as bitcoin’s market cap has increased. However, with the additional bullish catalysts we have this time, it’s possible this bull market may be as big, or even bigger, than that of 2020-21.

Many bitcoin commentators expected a $100,000 top in the last cycle. At that time, we had the China ban come in right in the middle of the bull market – a ban in the country that was the largest miner of bitcoin. This crashed the price from $60,000 to $30,000, and it took seven months from the previous peak ($60,000) to reach its all-time high of $68,000 in November 2021. Then the stock market began to turn at the prospect of runaway inflation and tightening monetary policy by the Fed.

It’s been suggested that the last bull market, spectacular as it was, was interrupted and hampered by the China ban and cut short by the Fed. Next time could be different – particularly, for example, if all these catalysts line up with a favourable macro environment such as a loosening of Fed policy.

Portfolio performance

YTD: +3% (as at 31 October 2023)

2022: +1%

2021: +10%

2020: +49%

2019: +51%

Portfolio

Trades in October

Trimmed VET.TO

Added to MSTR

Final thoughts

Bitcoin, as at November 2023, is a rare case where retail, in the know, has a great advantage over institutional. We understand the catalysts for bitcoin where most of the world does not. And we are able to act on the knowledge before much of institutional is able to buy via the ETFs. We are front running the smart money.

Bitcoin may look expensive to someone after a 100% gain in 2023. I would urge that investor to dedicate the time to doing the research – and to look at the models.

It is still early to buy bitcoin. However, time is running out to be an early adopter. Once institutional products launch from the likes of BlackRock and find their way into traditional portfolios, we are no longer in the “early adopters” part of the adoption “S” curve: we are in the “early majority”.

How many will take the time to understand the case for bitcoin and act on it before the institutional products launch?

Written by Timothy Lamb

Blog: www.retailbull.co.uk

Twitter: @theretailbull

Disclosure:

The writer owns shares in the securities listed in the stock portfolio at the time of writing.

Disclaimer:

This article is for informational purposes only, does not offer investment advice and does not recommend the purchase or sale of any security or investment product. Please see the full disclaimer on the About page.