This Research Report was commissioned by a subscriber of The Undervalued Newsletter and is free to all subscribers. If you would like to consider commissioning a report, details are available on request.

Coelacanth Energy (CEI.V) is a Canadian oil and gas exploration and development company, with lands in the Montney, north-eastern British Colombia. The entity was spun out of Leucrotta Energy in June 2022, following the acquisition of half of Leucrotta’s assets by Vermilion Energy (VET.TO).

The assets are almost entirely undeveloped, and the company has massive untapped resources as well as a net cash position to support its growth plan. It intends to grow production 50x, to transform from a 300-400 boe/d producer to a 20,000 boe/d producer, within four years.

Vermilion owns around 15% of the company and continues to buy shares in the open market. Speculation abounds that Vermilion might acquire the business, in which case it would have to pay a significant premium to the share price.

[SEE-luh-kanth]

“The Coelacanth is a predatory fish dating back 400 million years. It is a phenomenally adaptive fish that was most prolific during the time of Montney deposition, approximately 200 mya. This species was thought to be long extinct – until discovered off the coast of Indonesia in 1938. It is a survivor.”

– Coelacanth Energy

Contents

CEI.V stats

Assets & growth

Financials

Valuation

Management

Shareholders

Risks

Conclusion

CEI.V stats

Share price: C$0.78 (26 January 2023)

Shares outstanding: 419m

Market cap: C$327m

Net cash: C$70m

EV: C$257m

Assets & growth

The company has two Montney projects: Two Rivers West and Two Rivers East.

Two Rivers West is planned to come online by mid-2023, with Two Rivers West expected in operation by early 2024.

In Q3 2022, production was 334 boe/d. The aim is to increase output to 5,000 boe/d by Q2 2022, to 10,000 in early 2024, and then to use the cash flow from this to reach 20,000 boe/d in 2026.

The production mix in Q3 was about 16% oil and condensate (54 boe/d out of 334 boe/d), with the majority being gas. The company estimates the production mix, going forward, at 28% oil and condensate, 67% gas and 5% NGLs.

Coelacanth has a huge resource base, and has identified 8.9 billion bbls of Original Oil in Place and 8.6 tcf of Original Gas in Place. They have the existing infrastructure to handle the initial pad development.

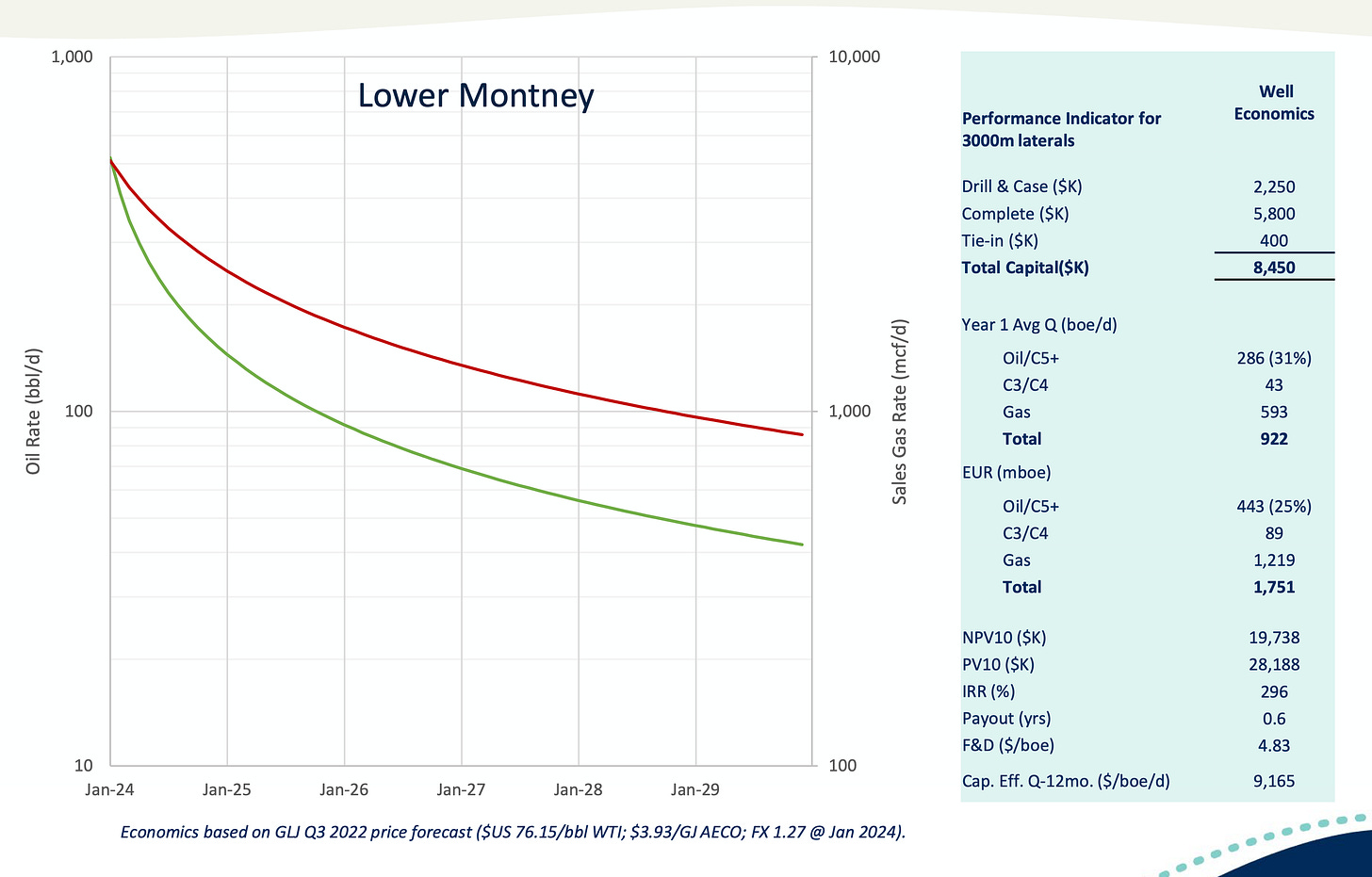

The wells look attractive and margins are high, with an estimated ~7-month pay-out on invested capital and a 296% IRR.

Note this is at US$76.15 WTI and C$3.93 AECO, which is higher than the forward strip gas price at around C$3.50 AECO.

There may be some delays to the timeline, I imagine, due to the supply constraints in the industry, but it seems perfectly possible to hit their production numbers. The CEO has a long and successful track record of scaling up production from a small base at six prior companies.

Financials

In Q3 2022, sales were a mere $2.1m and the company made a net loss of $850,000. Capex was $3.9m.

Coelacanth is, however, in an enviable financial position, with C$70m in cash and no debt. Management claims it is fully funded – this C$70m cash should be enough to develop Two Rivers West in 2023. Once that is running, peaking at 5,000 boe/d, they should be able to use the cash flow from that project to build out the second project.

This year should see a big ramp up in production and cash flow.

Valuation

Since there is currently minimal production, it is difficult to value Coelacanth on free cash flow projections. Valuing it on NAV seems a better approach – we can compare its assets to the Leucrotta assets, which were similar and were acquired by Vermilion in 2022.

The Leucrotta assets bought by Vermilion were 77,000 net acres adjacent to Coelacanth’s assets.

Before the spin-off of Coelacanth, the combined Leucrotta company had an estimated 18 billion bbls of Original Oil in Place (OOIP) and 17 tcf of Original Gas in Place (OGIP).

The assets were effectively divided in half: Coelacanth today has 8.9 billion bbls of OOIP and 8.6 tcf of OGIP, on 100,000 net acres.

The half bought by Vermilion was for C$477m, whereas the EV of Coelacanth is only C$257m.

However, Leucrotta had 4,400 boe/d of production, over 10 times that of CEI. CEI is aiming to get to the same production level in the coming months, but we can assume CEI’s $70m net cash will be used up to reach that production goal. Therefore, it’s fair to use the market cap rather than the EV to compare Coelacanth to the Leucrotta purchase price on a like-for-like basis.

The market cap of $327m still compares favourably to the $477m purchase price of Leucrotta for similar assets, indicating a ~45% premium would likely have to be paid if the assets sold privately.

Management

The CEO, Robert Zakresky, seems like exactly the guy you want at the helm to grow out the production. There is an interview with him here on the Ros Bros podcast, which is well worth a listen.

He has all his money in the company and owns 10% of the shares. He reached this point by compounding capital in the industry from a small base.

He started out as a tax accountant with C$100,000 in savings. He put C$50,000 into his first oil & gas company and the rest into a house. From there, he has compounded his capital by leading six previous companies through early-stage development. It’s an impressive story – you couldn’t wish for more than that in terms of record and skin in the game – and it’s clear he loves what he does.

He also says in the Ros Bros interview that Coelacanth could ultimately grow much bigger than 25,000 boe/d. He’s focusing only on reaching 25,000 within three to four years, but he says the resources are there to expand to 50,000 or 100,000 boe/d.

Shareholders

Coelacanth has minimal institutional ownership. Management owns 20% of the fully diluted shares, with 57% owned by insiders including Vermilion Energy.

Vermilion owns about 15% of the company and continues to purchase shares in the open market. There is speculation that Vermilion may acquire Coelacanth, in which case they would pay a decent premium to the share price.

It would be reasonable to assume the purchase price would be similar to that of the Leucrotta assets, which would allow for a 40-50% premium on the current share price, as described above. Additionally, if the share price were to appreciate to that level prior to announcement of an acquisition, a further premium, of perhaps 20-30% of the market cap, would likely be required.

Risks

Risks to an investment in Coelacanth chiefly include commodity prices, and delays to the development of the assets due to supply constraints and execution issues.

It is basically a small cap, and in early-stage development, so it’s a higher risk way to get exposure to commodity prices. It would be vulnerable in a scenario of unprofitable commodity prices like we saw in 2020.

It’s likely the wells will be similar to Leurotta’s and the ones already drilled, which suggests good margins at forward prices. However, it’s also possible some of the wells could turn out to be less productive.

A buyout of the company not occurring is not necessarily a risk, as the stock may do better in the long run without being acquired. However, if an investor’s thesis is the buyout possibility, to remove the risk and uplift the stock price, this is speculative and a buyout may not occur.

Conclusion

Coelacanth Energy is a compelling story and presents two ways to win: either by organic development of the assets by a dedicated CEO, or by a buyout for a 40-50% premium on the current share price. It’s both a growth story, with strong returns potential for the energy bull-cycle, and a buyout candidate.

Further, note that gas prices are low at the moment and the stock has consequently come down from its prior highs – it should give good AECO gas exposure, as well as oil, in the coming months and years, which in my view is likely to be a further tailwind.

All in all, it looks undervalued, it has several catalysts and I rate it a buy.

Thank you for supporting The Undervalued Newsletter!

With best wishes,

Timothy Lamb.

Blog: www.retailbull.co.uk

Twitter: @theretailbull

Disclosure:

The writer does not own shares in CEI.V at the time of writing, but may initiate a position.

Disclaimer:

This article is for informational purposes only, does not offer investment advice and does not recommend the purchase or sale of any security or investment product. Please see the full disclaimer on the About page.