And now for something completely different: autonomous trucking!

Embark Technology (EMBK) is a pre-revenue start-up autonomous trucking company that got caught up in the SPAC bubble and bust. The stock is down some 98% from its high. At this point, it seems the market has thrown out the baby with the bathwater: it has far more net cash on the balance sheet than the market cap and, I believe, a good chance of success in capturing a share of the US autonomous trucking industry. It’s an intriguing candidate for a potential 100 bagger!

Contents

EMBK stats

Autonomous trucking: background

Background to Embark

Competitive advantages

Technology milestones

Financials

Valuation

Risks

Conclusion

EMBK stats

Share price: $3.95

Share count: 23.1m

Market cap: $91m

Net cash: $191m

EV: -$100m (negative!)

Autonomous trucking: background

Autonomous trucking is set on alleviating the truck driver shortage while increasing efficiency and lowering emissions. The idea is to use diesel trucks rather than electric vehicles (EVs) for the foreseeable future, as diesel remains the most efficient fuel for long-distance, high-volume transport – the size of the battery needed for an electric truck would be prohibitive, and long waits for battery recharging would be inefficient.

Autonomous vehicles (AVs) are an answer to the issues with human truck drivers, including driver shortages, the need for drivers to rest, and safety. They can also increase efficiency and reduce emissions. The huge scale of the logistics industry means even small efficiency gains can have a big impact. Beyond 300-mile routes, there is a large cost saving due to the fact AI doesn’t need to rest or stay overnight at a hotel.

In terms of feasibility, autonomous trucks are already in use in mining, particularly in the Australian iron ore mining industry, and the US regulatory environment is supportive. Over 40 states now allow fully autonomous truck testing and over 20 allow fully autonomous deployment. Due to the shortage of truck drivers, there is little opposition to autonomy from within the industry. Embark’s plan to have trucks running depot-to-depot on US freeways removes a lot of complexities from the self-driving problem – Embark’s truck routes are largely one-way traffic with no pedestrians or cyclists.

It seems AVs will be a significant part of the logistics sector in the US within a few years. The addressable market is enormous with a $1tn domestic freight industry in the US, of which $700bn is truck freight.

The challenge for Embark is in taking a share of the market.

Background to Embark

Embark has the longest track record of focus solely on trucks.

The company’s CEO, Alex Rodrigues, is 27 years old. At age 15, he led a team that won the World Robotics Championship. He then studied Robotics at the University of Waterloo, Ontario, where he met Embark’s Chief Technology Officer, Brandon Moak – the two of them built an autonomous golf cart and then went on to found Embark.

Embark started with $40,000 of seed money in 2016, and has since attracted some world class investors, including Sequoia. By 2018, Embark completed a test run from coast to coast, between LA and Florida.

In November 2021, the company went public, following an SPAC merger with Northern Genesis Acquisition Corp. II, in a $5.2bn deal. The market cap was over $4.5bn at the end of 2021 and, in 2022, crashed down 98% to less than $100m.

The company is pre-revenue, targeting 2024 for beginning commercial operations. However, it has more cash on the balance sheet than the market cap – a negative enterprise value (EV) of -$100m – which gives it a strong chance of reaching commercial operations.

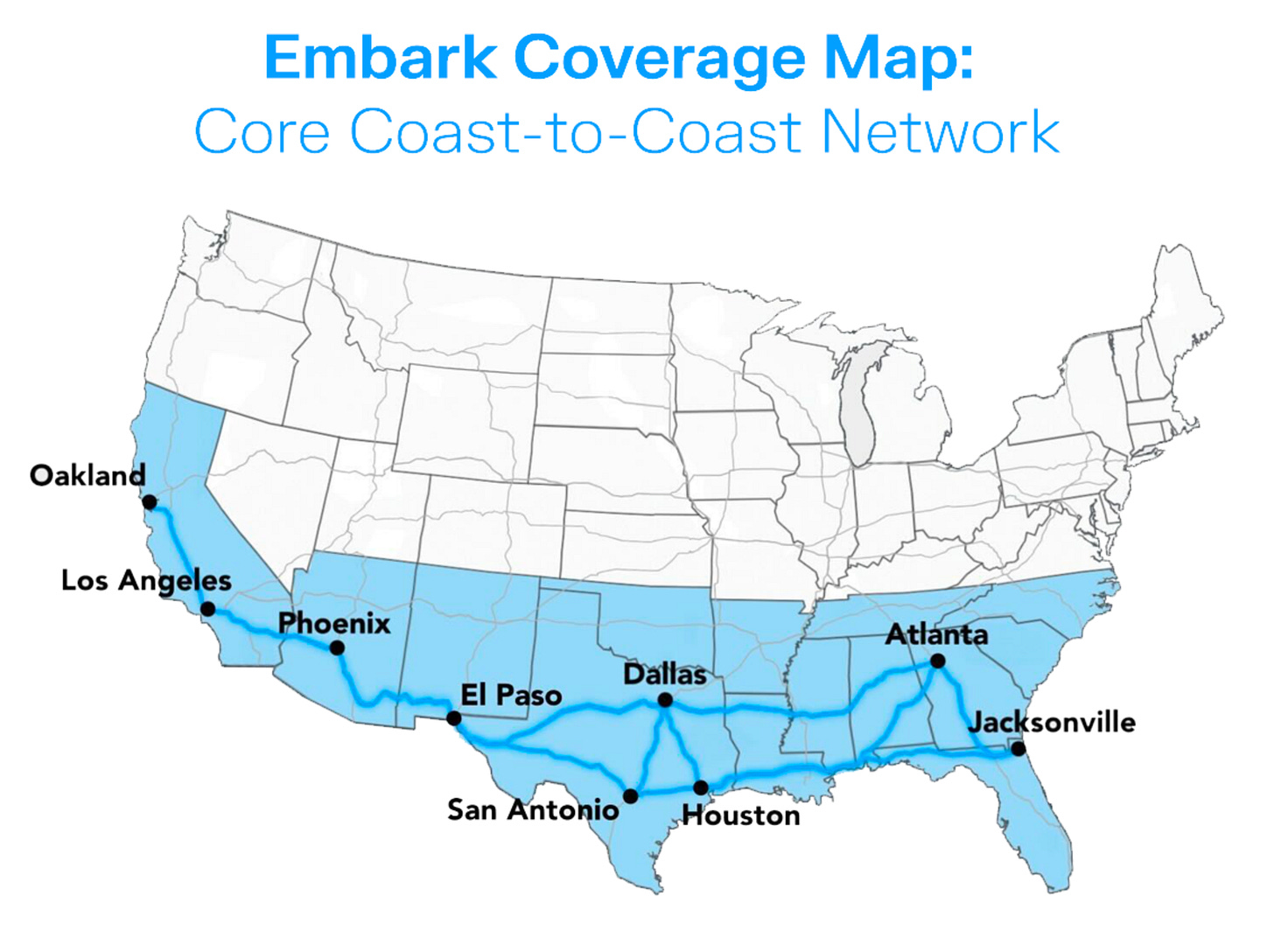

In November 2022, Embark launched its Coast-To-Coast Autonomous Trucking Network, preparing Sunbelt markets to be served by Embark fleet partners. The coverage map includes nine transfer point sites to accommodate autonomous freight volume and to provide operational support for carriers. Embark has secured the necessary real estate sites and support services.

Commercial operations are planned for the sunbelt in 2024 and for the remainder of the lower 48 states in 2026.

Competitive advantages

Embark’s approach is to simplify a complex problem by focusing solely on trucks and on developing “the smallest set of capabilities necessary to deploy a safe commercial product”.

Its business model is asset light and high margin: a software-as-a-service (SaaS) model. The company does not manufacture trucks, but has developed a software/hardware package that is optimised to work with any of the four major US truck manufacturers.

The package consists of Embark Driver – which is the software – and the hardware, Embark’s proprietary Vision Map Fusion technology. This uses a combination of cameras, radar and LiDAR, three technologies that combine with GPS to see the road in all driving conditions. The map is updated in real time, allowing the software to detect and respond to new situations on the road.

Embark’s customers are the carriers, who can licence Embark’s technology for a subscription fee per mile driven. Without the need to build or own trucks, the business model does not require large capex to scale.

Embark has an impressive list of partnerships, including HP, BYD, NVIDIA, Ryder, Cummins and ZF, and has had some world class backers, including Sequoia, Tiger Global, Canada Pension Plan and Mubadala (UAE sovereign wealth fund).

Key competitors include Aurora Innovation, Plus.ai and TuSimple. Embark is differentiated by being asset-light and only SaaS, by its laser focus solely on trucks, and by being the first mover with the longest track record in the space.

Technology milestones

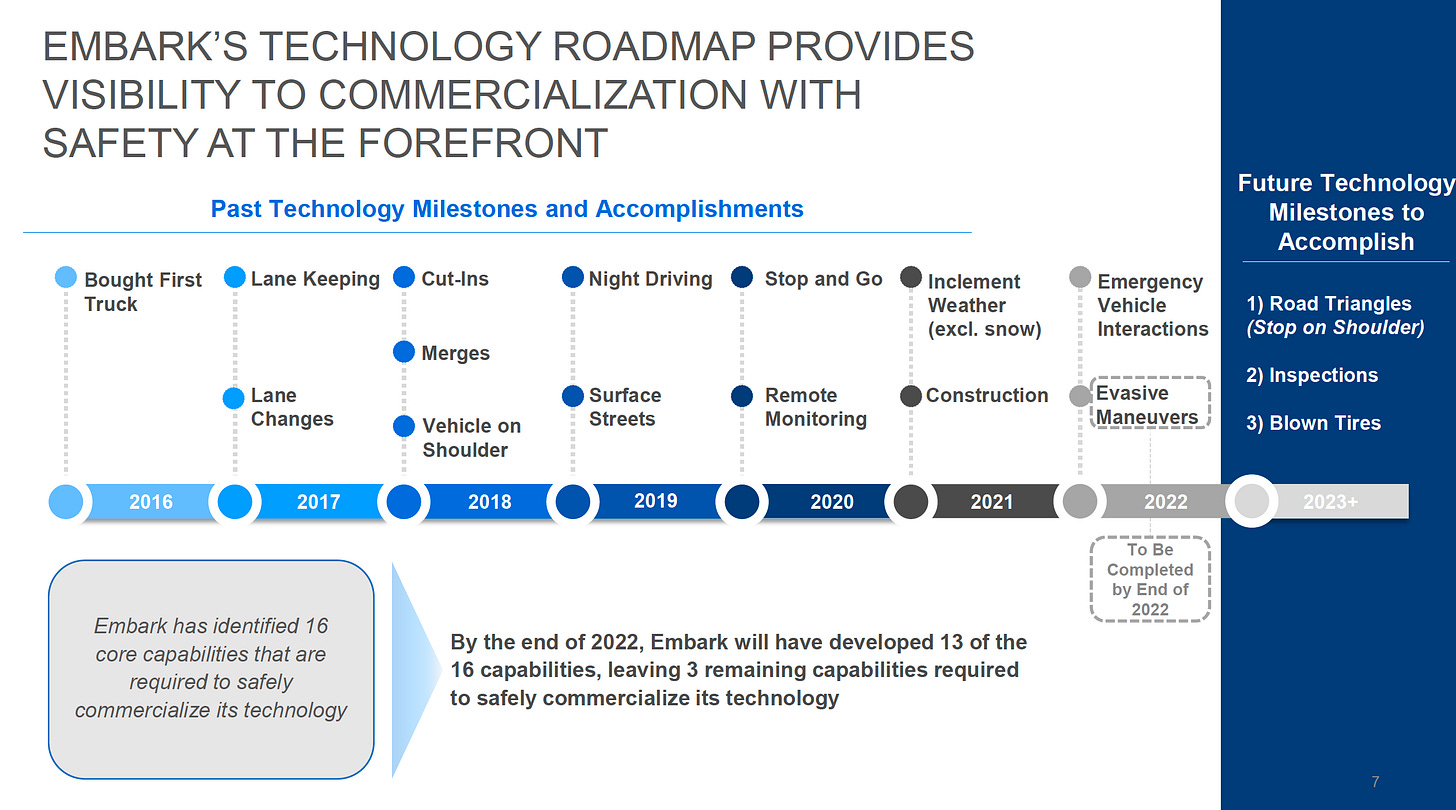

Embark identified 16 capabilities that are required to safely commercialise its technology. Three capabilities are left to develop in 2023-4.

Financials

At the end of Q3, the company had $248m in total assets, of which $191m was cash; it had no debt, and only $39m in total liabilities. The market cap is $91m.

In the nine months to 30 September, it made a loss of $68m, and it has reaffirmed its 2022 cash flow spend guidance of $100-$115m. At this rate of cash burn, it should have enough cash to last until its mid-2024 target, when commercial operations at scale are planned to commence.

If it does take longer to start commercial operations, I believe the company should be able to raise some additional capital, if needed, through debt or share issuance.

Embark has traded as if it has a high chance of going bust – but it isn’t easy to go bust any time soon with no debt, two years of cash reserves and most of the costs being discretionary R&D expenses.

Valuation

The company is hard to value, which partly explains the insane volatility in the share price. The addressable market is enormous and so are the margins (estimated at ~68%). It comes down to a bet on whether Embark will capture a share of the US trucking industry. If it does, it could be a 100 bagger; if it fails, it could be a zero.

Putting a present value on the company would involve making up probabilities of success, and any number would not be accurate for this reason. However, I believe the company has a good chance of hitting its 2024 target for commercial operations and capturing a share of the market, and so it seems hugely undervalued, trading below net cash when potential earnings are many times the current market cap. The case I’m putting forward for the stock is a long-term hold until at least commercial operations, not just trading it up to a present fair value.

The company’s projections are for 1.1% penetration of the US trucking industry in 2024, and 3.3% in 2025. At the company’s fee of 44 cents a mile, this equates to $877m and $2.75bn of revenue respectively, resulting in gross profit of $593m and $1.9bn. EBITDA in 2025 is projected at $640m.

Even if this 3.3% penetration is delayed a couple of years, seven times the current market cap in EBITDA would be worth waiting for. And there is plenty of room for further growth at a mere 3.3% market share. Applying a 10-20 multiple to EBITDA, one can easily see how the company could be worth $5bn-10bn, a 50-100 bagger from here.

Risks

There are risks the company may not achieve commercial operations before running out of cash, in which case, there could be dilution and/or debt issuance.

The speed of industry take-up could be slower than anticipated, although there will be pressure on carriers to do so due to the driver shortage.

A fatal accident caused by any player in the industry, as companies compete to achieve commercial operations, could cause regulatory risk. However, regulators are largely supportive of autonomous trucking as things stand.

Competition from other companies is a risk, although the addressable market is so large that only a small percentage is required for EMBK to do very well. Embark remains a leader in the space, with clear competitive advantages. Competition could force the subscription prices down, however.

Competitors using Embark’s intellectual property could be a further risk. However, management says they are not overly concerned about this as it is in the integration of all the technology, rather than in the individual parts of the technology, where Embark has an advantage.

Conclusion

Embark Technology (EMBK) is down some 98% from its high, presenting an opportunity to own a potentially transformative business for below net cash value. I believe that, with its competitive advantages, leadership status in the autonomous trucking industry and its strong management team, it has a good chance of success in capturing a share of the US trucking industry.

The upside is enormous. It may be high risk, but there is a price at which a high-risk investment is attractive. Once understanding the risks of investing in a pre-revenue start-up, we should size accordingly – it's best suited for a small position in my view – and the asymmetric nature of the bet makes a small position all that’s required.

The chance to own a quality business model in a transformative industry for far less than its net cash value – a company that could be a 100 bagger – doesn’t come along that often, and it’s an opportunity I can’t pass up!

Thank you for supporting The Undervalued Newsletter!

With best wishes,

Timothy Lamb.

Blog: www.retailbull.co.uk

Twitter: @theretailbull

Disclosure:

The writer owns shares in EMBK at the time of writing.

Disclaimer:

This article is for informational purposes only, does not offer investment advice and does not recommend the purchase or sale of any security or investment product. Please see the full disclaimer on the About page.