Undervalued Report: Vermillion Energy – Q3 Earnings Update

32% FCF yield in Q3 – and investors dump the stock

Dear subscriber,

So much has happened with Vermilion Energy (VET.TO) in recent weeks that it’s already time to look at it again. Since my max bullish article in August (published on Seeking Alpha), the European gas (TTF) price has crashed down, the EU has implemented a painful windfall tax on domestic energy producers and the company’s third quarter earnings report caused the market to dump the stock.

Although, on the face of it, it does not appear as much of a cinch as it did in July-August, there was a huge margin of safety here: Vermilion remains undervalued at strip commodity prices. If, on top of this, we expect European gas prices to go higher this winter and next winter, then Vermilion is again a no-brainer. It remains my largest position.

Natural Gas EU Dutch TTF (EUR/MWh)

Contents

VET.TO stats

Vermilion: brief overview

Q3 earnings discussion

Hedges

Free cash flow

Capital allocation

Valuation

Risks

Conclusion

VET.TO stats

Share price: C$28.25

Share count: 163m

Market cap: C$4.6bn

Net debt: C$1.4bn

Enterprise value (EV): C$6.0bn

Production: 84,247 boe/d (Q3)

Reserves: 481m boe – 9.7 years 1P and 15.4 years 2p (31 December 2021, not including 2022 acquisitions)

Vermilion: brief overview

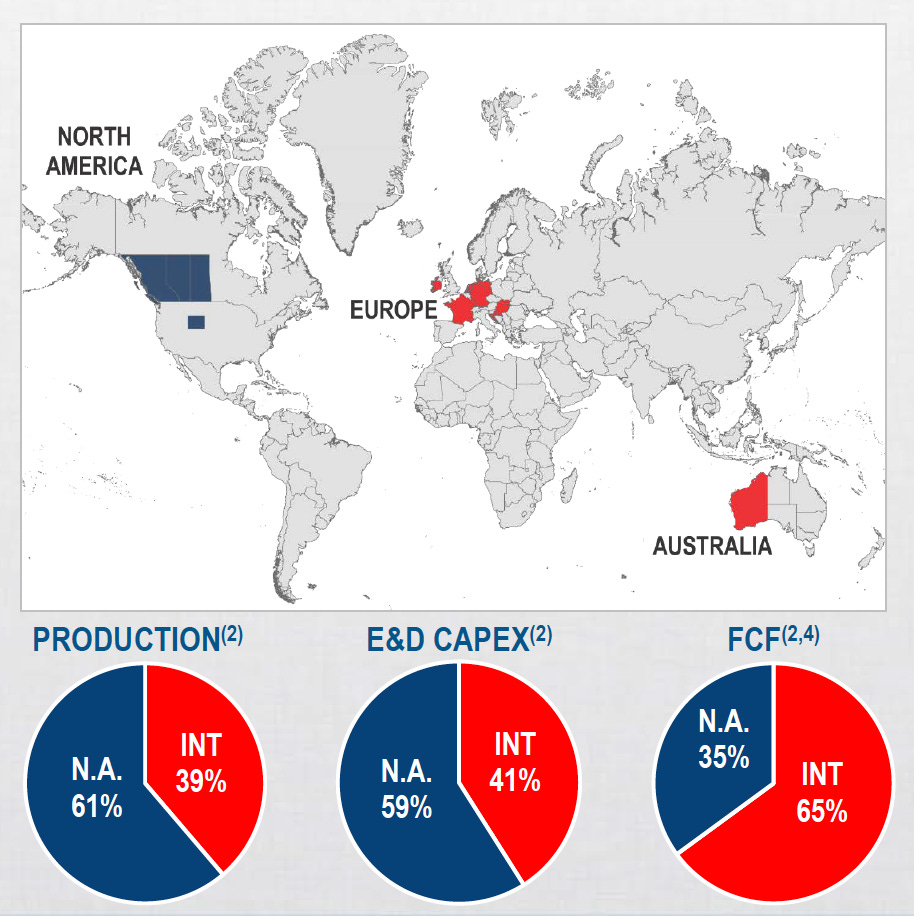

Vermilion Energy is a Canadian oil and gas producer that is diversified across North America, Europe and Australia.

Production in Q3 was 84,247 boe/d, and the company is forecasting 2022 exit production of 95,000 to 100,000 boe/d, including the Corrib Natural Gas Project acquisition yet to close. Management’s plan is to then keep production roughly flat for the foreseeable future, perhaps increasing European gas weighting to offset natural declines elsewhere.

The management are European gas bulls, and the company’s Euro gas assets make up about 22% of production, including the Corrib acquisition.

In late 2021, Vermilion announced an agreement to acquire an additional 36.5% working interest in its operated Corrib Natural Gas Project, off the coast of Ireland. The Corrib acquisition is now expected to close in Q1 2023 and adds ~7,700 boe/d of European gas production, with end of field life estimated at 2034. The deal has an effective date of 1 January 2022; all the free cash flow (FCF) after this date will accrue to Vermilion and be netted off the purchase price. This was a great acquisition – they have essentially bought the asset with its own 2022 FCF (pre-windfall tax).

Q3 earnings discussion

The stock dumped on the Q3 earnings release which, on the face of it, contained quite the toxic brew of bad news:

Free cash flow (FCF) came in lower than expected, at C$324m or C$1.98/share.

Capex was higher than anticipated at C$184m.

Production decreased by 1% from the previous quarter.

The closure of the Corrib acquisition was pushed back from Q4 2022 until Q1 2023.

Three wells that were drilled in Hungary came up dry.

The company estimated its exposure to the newly announced EU windfall tax could be in the range of C$250m-C$350m for 2022.

On the back of this unexpected liability, Vermilion announced it anticipated it would be below its year-end debt target of C$1.2bn and would also suspend its share buyback programme in Q4!

Before you are tempted to throw in the towel, let’s break down the numbers.

Firstly, fund flows from operations (FFO) was up 12% on the quarter, despite the fall in oil prices, to C$508m. Including the Corrib acquisition, FFO was $611 million and FCF was $426 million. (FFO is simply FCF plus capex.)

Of the C$184m of capex, C$168m was used in investing activities “primarily related to the offshore Australia drilling campaign which was delayed from the previous quarter”. The capital budget of C$550m in 2022 remains unchanged.

If we use the annual capex number (C$550m) divided by 4 for the quarter, we get C$473.5m FCF (including Corrib). That’s a 32% annualised FCF yield on the enterprise value (EV).

Even with the expected windfall tax (C$300m/4), that’s C$398.5m FCF in Q3, a 27% FCF yield to EV.

Furthermore, the company reported a C$138m loss on hedging in the quarter (not even including the additional Corrib hedging), which can be added back to FCF to see unhedged results: the potential of the company.

Depsite the 1% decrease in production, the production guidance for the year is unchanged. The company explains the 1% decrease in production was due to “third-party downtime in Canada and delayed start-up of our Turner wells in the United States”, and wildfire-related downtime in France.

Notably, the new wells drilled in Australia, that the increased capex was for, recovered 40% of the invested capital in their first two months of production!

Apart from the dreaded windfall tax, which we knew about already – don’t be fooled by the market’s reaction – this was a good quarter!

Hedges

The company did not take full advantage of the August European gas spike as I wanted to see. They could have hedged in a lot more 2023 production when the strip was at US$60-70.

When the 2023 Euro gas hedging was at 45% in early August, the average ceiling was C$32/mmbtu, compared to C$24/mmbtu for 2022. Despite a lot of the hedging being done at lower prices as a necessary part of the Corrib deal, this is a decent improvement going into 2023. As you can see below, the 2023 hedging has since moved up a little from 45% to 50%, which pushes the average ceiling for 2023 above that C$32/mmbtu.

Free cash flow

For 2022, the company is now estimating C$9.17 of FCF per share, including the Corrib acquisition and the EU windfall tax, a ~30% FCF yield on the equity. The additional Corrib earnings set to appear on the financial statements in Q1 at least cancel out the windfall tax liability.

Moving onto 2023, and I’m estimating ~C$1.8bn FCF, or ~C$11 per share.

This is using 2023 hedging and average strip pricing (US$37/Mcf TTF and US$84 WTI). It includes Corrib and a C$300m windfall tax. Interestingly, I believe 2023’s results can beat 2022’s, even at strip pricing, due to improved hedging and slightly higher production.

This is a 39% FCF yield on the equity and a 31% FCF yield on the EV – a very competitive yield among the undervalued Canadian energy sector.

If we are bullish energy, we should also note that at $110 WTI and $60 TTF, the company could make C$3bn FCF in 2023, half its EV in one year!

Capital allocation

The buyback programme has been suspended in Q4, but the following remains the capital return framework going forward:

In Q3, Vermilion paid the quarterly dividend of C$0.08 per share and repurchased 2.3 million shares for C$72m. With the dividend and buybacks, the company returned C$85m to shareholders, 26% of reported FCF, which was in line with the framework above.

The majority of FCF in Q3 was allocated to debt reduction, and net debt decreased by ~11% to C$1.4bn.

The Q3 report says that they anticipate the 2023 capital budget will be similar to 2022’s, which is C$550m, but with a greater proportion of the budget potentially allocated to European gas:

“We have the ability and desire to drill more wells in Europe, and, if ongoing discussions with regulators are productive, we will look to allocate additional capital to the region in 2023.”

I notice the year-end net debt projection in the FCF chart (above in the FCF section) is now higher than Q3’s C$1.4bn, at C$1.6bn. I imagine the reason for this is the windfall tax on top of raising cash to pay for whatever part of the Corrib acquisition isn’t covered by the asset’s own 2022 FCF.

I am a little wary of this increased net debt projection, however, and I’m hoping there is not another acquisition on the cards this year. Despite being in favour of any accretive Euro gas deal similar to Corrib, I would first like to see the net debt firmly below that C$1bn milestone so that shareholders can start receiving 50-75% of the FCF. Also, I can’t imagine the market would react well to another acquisition at this stage!

The windfall tax has pushed back the capital returns, and it look like patience is needed for another couple of quarters before we can expect 50% of the FCF to be returned.

Valuation

The DCF valuations have naturally come down quite a bit since I published the Seeking Alpha article in August at the peak of the European gas spike.

I now see the stock at fair value at around C$57 per share – double the current share price – a base case valuation with commodity prices similar to the forward strip (at strip to 2025 and using 2025 prices out to 2032 – $70 WTI and $21 TTF)

My bull case is C$88 per share, using $100 WTI throughout, $50 TTF in 2023 and $25 TTF from 2024-32.

My bear case is C$28 per share, using strip pricing to 2024, and then $60 WTI and $10 TTF from 2025-32.

I have included the EU windfall tax in 2023 only. 2024 and thereafter are unhedged in the DCF model (although there is now some hedging in 2024 which is at better than strip pricing).

Risks

Some key risks, apart from the obvious commodity prices, are:

EU legislation risk – that EU states may extend or increase the windfall tax.

Capital allocation – particularly the risk that Vermilion could undertake a poor acquisition.

Further delay to the closure of the Corrib acquisition.

Conclusion

Vermilion does not, on the face of it, seem quite so much of a cinch here as it did at points earlier in the year. The European gas price has crashed down to around its baseline level on the 1-year chart, and the EU windfall tax has hit profit expectations for 2022 and 2023. Risk of further EU legislation can’t be ruled out, nor can the risk of a poorly timed acquisition.

However, there was a huge margin of safety with the stock. Vermilion remains undervalued at strip commodity prices, with a fair value of ~C$57 per share, double the current share price.

It may be that buying after the spike in Euro gas prices and the announcement of the windfall tax is considerably lower risk: it’s unlikely there will be another tax shock of comparable magnitude from the EU, and I strongly suspect the dip in gas prices is the lull before the storm. If we expect higher oil and/or gas prices on top of the current low valuation, the stock is still a no-brainer.

With recent events, the timeline for a big move in the share price seems to have been pushed back. With capital returns delayed, EU gas storage full and a mild autumn, the focus now turns to next winter – for which it’s highly doubtful Europe will be able to refill storage without Russian volumes. (However, I would be surprised not to see another major TTF spike before this winter is out!)

Due to the change of timing for a rerating, I sold my January 2023 call options, and I also trimmed my shares, in October, but the stock remains my largest position at about 40% of the stock portfolio.

Patience and resolve are required to ride the European Energy Crisis – it is a multi-year trade. The EU will attempt any misguided policy to get the gas price down, but – without actually increasing domestic supply and signing long-term supply contracts, or making peace with Russia – I’m of the opinion the policies will ultimately make the Crisis worse and send Euro gas prices higher for longer.

Thank you for supporting The Undervalued Newsletter!

With best wishes,

Timothy Lamb.

Blog: www.retailbull.co.uk

Twitter: @theretailbull

Disclosure:

The writer owns shares in VET.TO at the time of writing.

Disclaimer:

This article is for informational purposes only, does not offer investment advice and does not recommend the purchase or sale of any security or investment product. Please see the full disclaimer on the About page.